Supplier User Guide

01

The onboarding form should be completed within 48 hours. This is to ensure that we can process your invoice in a timely manner and not cause any delays. Errors on the form submission will result in a rejection from the HSM Supplier Management Team.

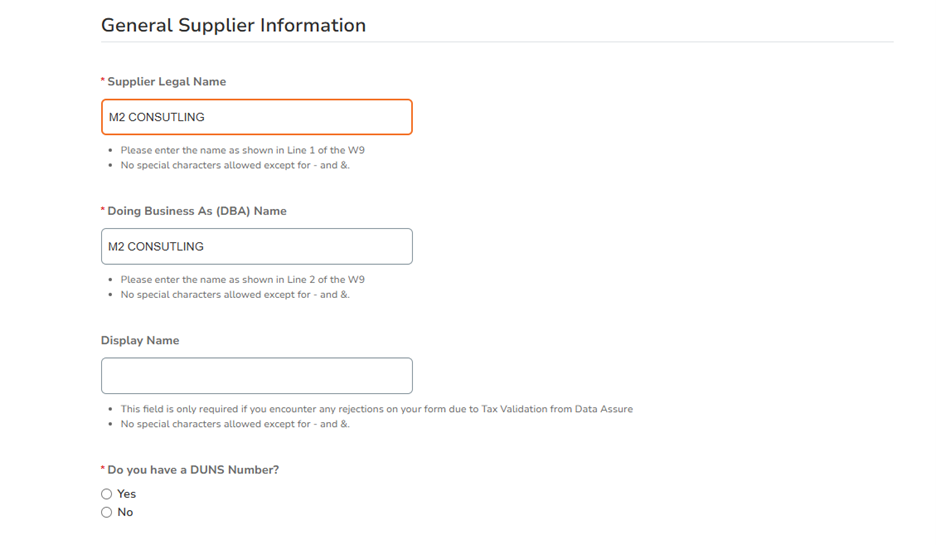

General Supplier Information

02

SUPPLIER LEGAL NAME: Your company’s full legal name (The official, registered name of the business or individual, used for all formal and tax purposes). This name should be the same name listed on line 1 of your company’s W8/W9. Please list name in line one into the Supplier Legal name field.

Doing Business As (DBA) name: Does your company go by another name (The business name you are operating under other than its legal one)? If so, that should be indicated on line 2 of your W8/W9. If you have a DBA name listed on line 2 of your W8/W9 please enter that name in the DBA field. If no, name listed on line 2 please enter your company’s legal name in the DBA field

Display Name: Not a required field and can be left blank.

DUNS Number: If your company has a DUNS number, please select ‘Yes’ and enter the number. If your company does not have a DUNS number or you are unsure, please select ‘No.’

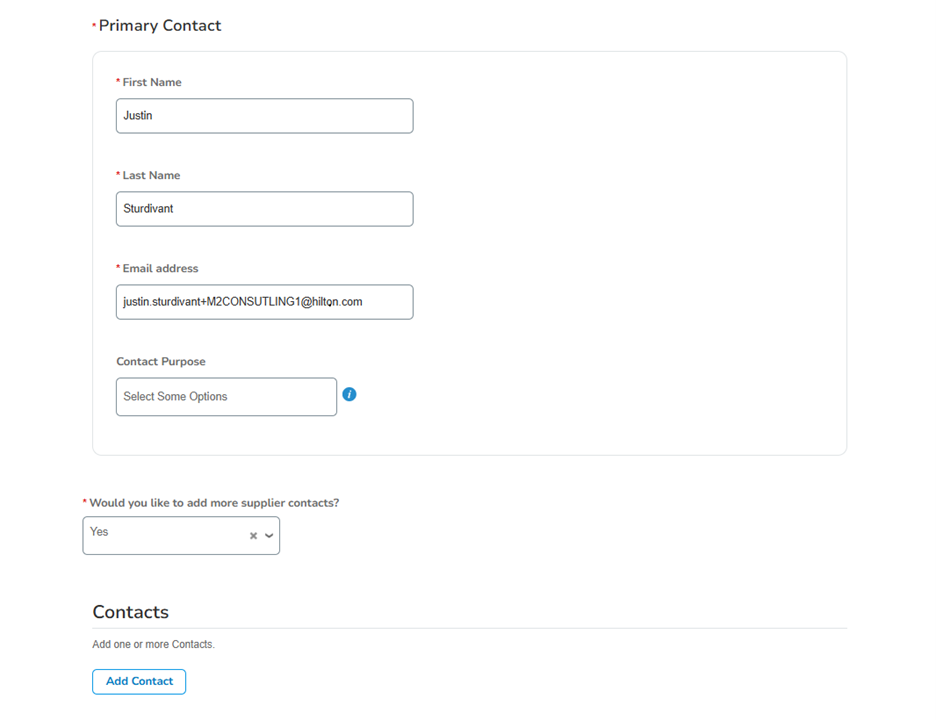

Supplier Contact Information

03

Primary Contact: This individual will be the main point of contact at your company for any communication from HSM. Please populate the required fields.

If you would like to add additional supplier contact, please select “yes” to the would you like to add additional supplier contact question. You will be able to add additional contact by clicking on Add Contact.

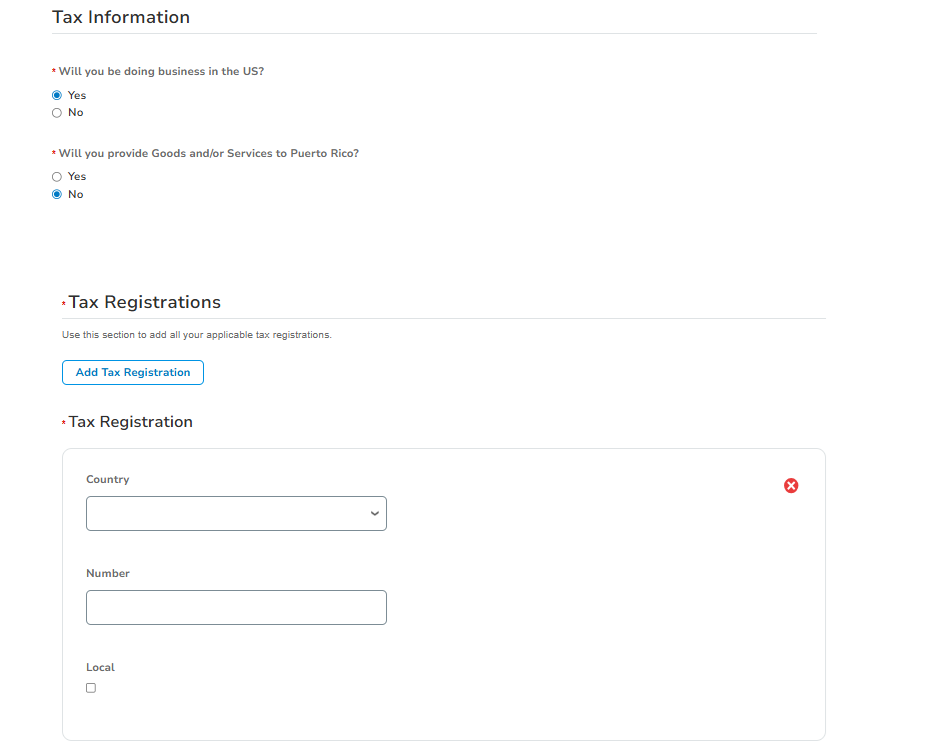

Tax Information

04

Will you be doing business in the US?

- All US-based suppliers should answer yes to this question. Upon answering yes, you will be prompted to upload a signed copy of your company’s W9 in the Federal Tax Form Section

- International Suppliers: please answer yes or no depending on where the services you’re preforming are located. If you answer yes, you will be prompted to attach a signed copy of your company's W8 in the Federal Tax Form Section. If you answer no, you will not be prompted to attach your company’s W8

Will you provide Goods and/or Services to Puerto Rico?

- If yes, you will be prompted by another yes/no question asking if you are a withholding supplier.

Tax Registration: Please select the country your company is registered in from the drop down. Enter your company Tax Number in the Number field.

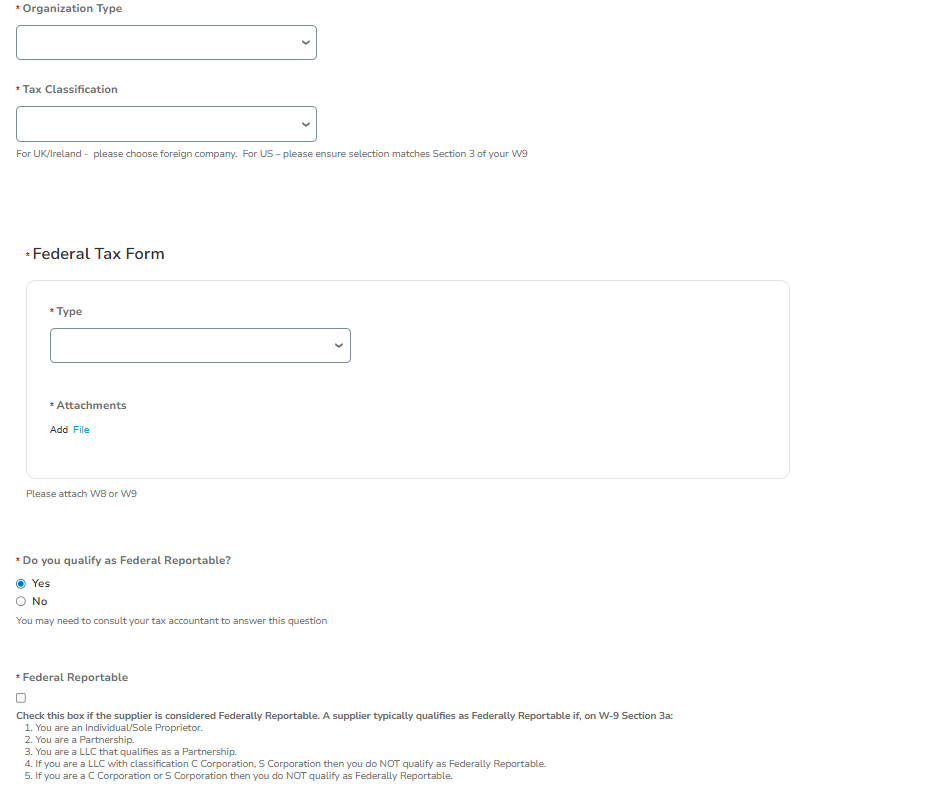

Organization Type: Please enter your company’s organizational type from the options provided in the drop-down menu. If you are using your SSN for your federal tax ID number, please select Individual.

Tax Classification: Please select the tax classification that aligns with your company’s classification. For US-registered suppliers, select the classification that aligns with box 3 of your W9. For international suppliers you will likely choose Foreign Company.

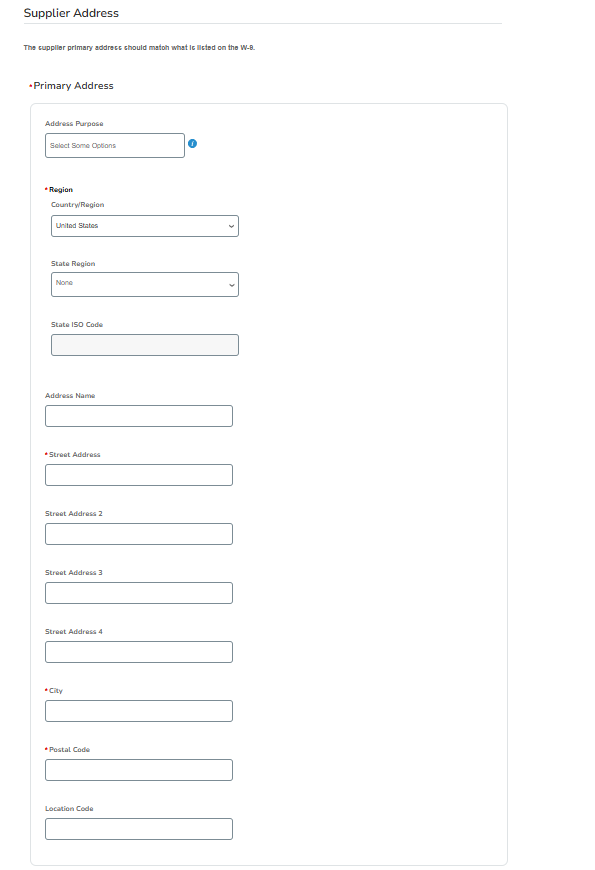

Supplier Address

05

Please enter that address that is listed on your company’s W8/W9.

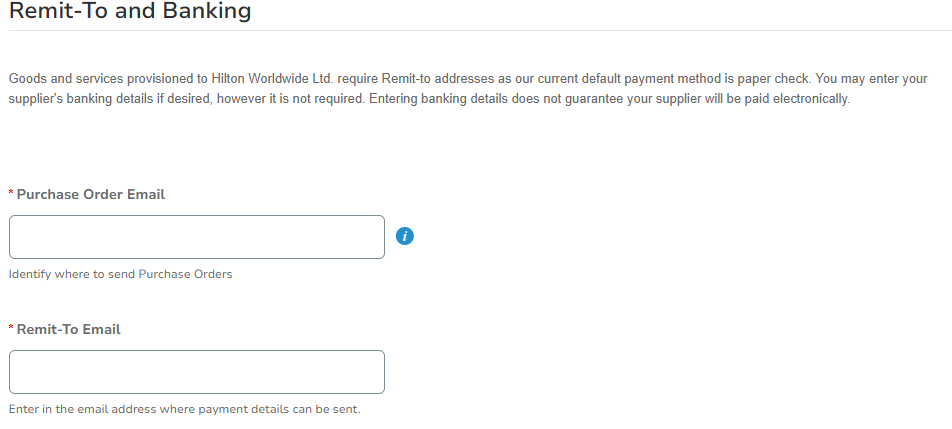

Remt-To and Banking

06

Purchase Order Email: The email address provided in this field will be receiving all the purchase orders issued to your company by Hilton. You can add more than one PO Email in the field.

Note: This email is the email address that will receive the PDF version of the PO. All other users that are linked to Hilton’s account will get a notification that a PO has been issued.

Remit-To Email: The email address provided in this field will receive email confirmation that payment has been made.

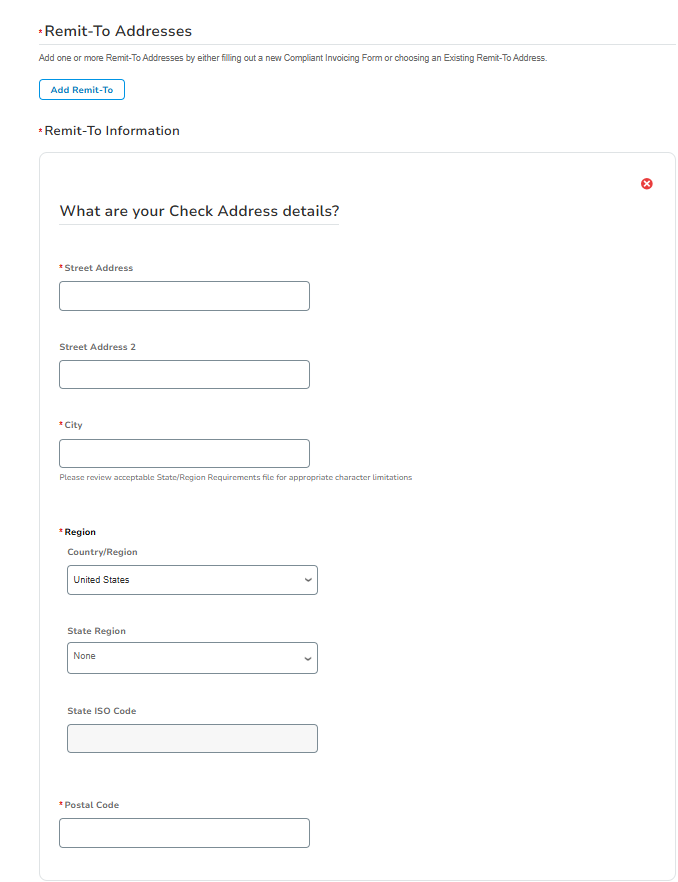

Remit-To Address

07

Hilton’s standard payment method for domestic suppliers is check payment. All international suppliers with international banks will be paid via wire transfer. Click on "Add Remit-To". You will be prompt to add your remit-to address.

For US-based suppliers with a domestic bank: this address must be where you are expecting check payment mailed. As noted, earlier Hilton’s standard payment for domestic bank is check payment.

For international suppliers with an international bank: please make sure the address you use on the onboarding form is the same remit-to that will be used on the invoice submission.

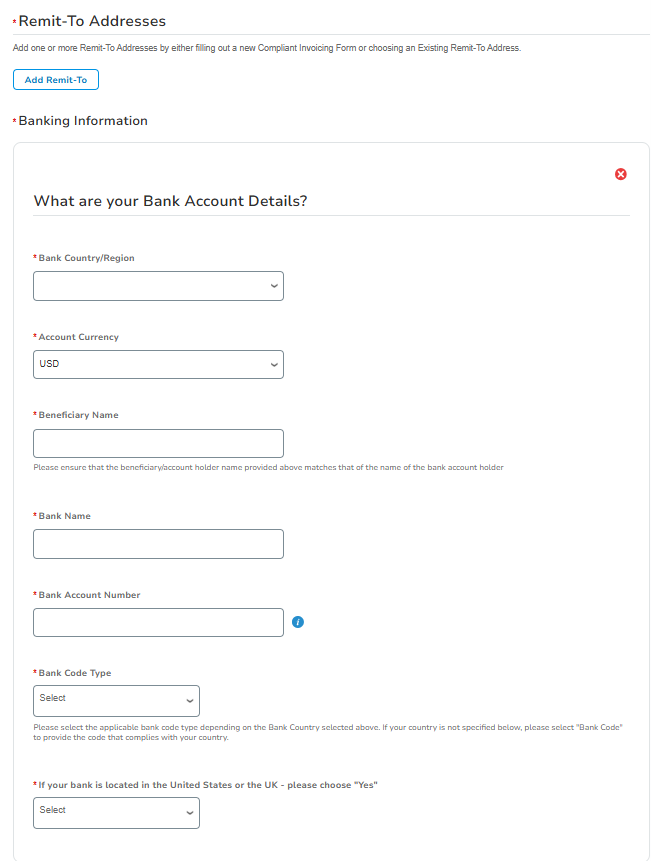

Banking Information

08

After adding your remit-to address you will need to click on “Add Remit-To” once more in order to add your banking details.

Please enter your company’s bank information in this section. Please note that information in this section must match the banking information provided in the bank form attachment.

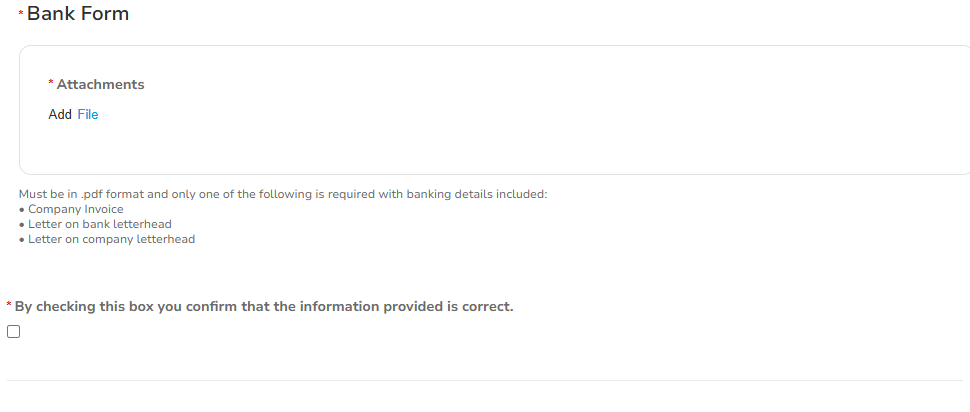

Bank Form

09

The form is used to verify your company’s bank information. This form must be a pdf on company letterhead, bank letterhead, or an invoice. The form should include Bank Name and Address, Account Number, and the applicable bank code type based on your bank’s location.

*Even though you have attached your banking information via the bank form. We still need you to populate that information on Hilton’s onboarding form in the section above.

Please check the box to confirm that all information provided is correct

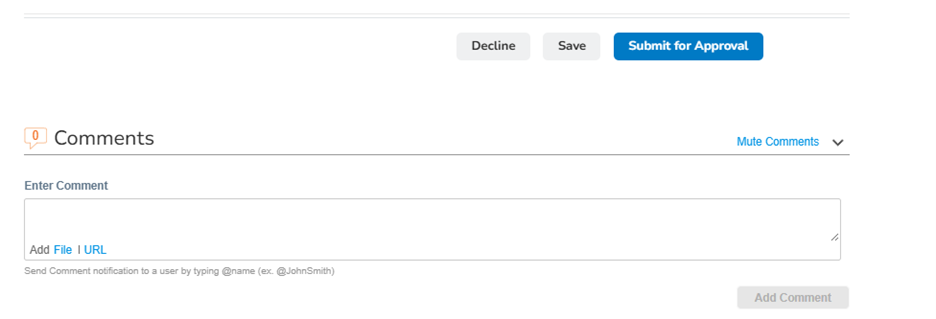

Review and Submit for Approval

12

Once everything has been reviewed, click on the blue “Submit for Approval button” which will get routed to HSM. Upon submission, you should receive a green bar across the top of the page. If there is an error, you will receive a red bar and highlighted field in red for the error.

If there is further information that needs to be provided to Hilton, enter the additional information in the “comments” field.

In the case anything needs to be clarified or adjusted, HSM will contact you for clarification or send the form back with additional comments.